The Leak

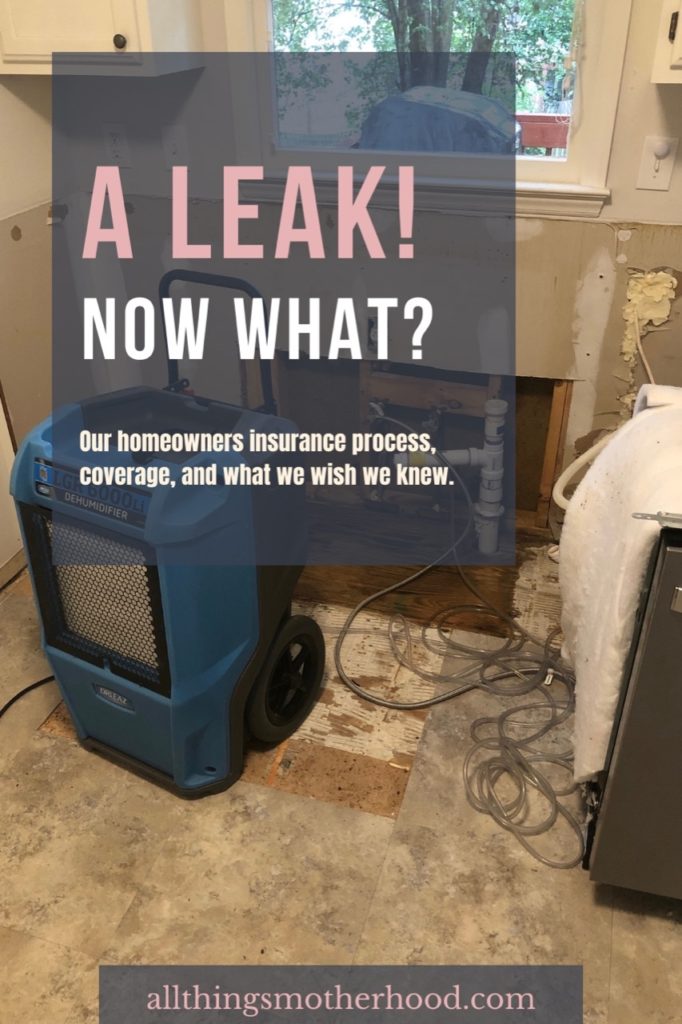

At the end of May we discovered a leak and mold in our kitchen! I went to turn the garburator on, or as Americans say it–garbage disposal, and it wouldn’t turn on. I hadn’t used it for a few days and didn’t know that it had been leaking! Everything under our sink area was soaked.

I quickly called for my husband and we began to take everything out from under the sink and dry it out. We took the plywood bottom (that the previous owners had put there) out from the bottom of the kitchen cabinet to check how much water had gotten down below.

When my husband took it off, we found MOLD and the nasty original bottom of the cabinet. We took some pictures and quickly sealed it off with plastic garbage bags, it smelled so bad.

It was a Saturday, but we called our insurance–Lighthouse– because we were pretty sure we were going to be filing a claim.

The Leak Inspections

In the mean time, we called a water and mold remediation company to have them come look at the damage from the leak. They determined that the granite would have to be removed, two of the cabinets and some of the floor for proper cleaning and mitigation.

He went into our crawl space and determined there was no mold–such a relief! His quote came back at almost 2K so we decided it would be in our best interest to get more quotes.

The next guy came and his prognoses was totally different. He basically said that it really wasn’t that big of a deal and that all he needed to do was clean out the area and no containment was necessary due to the size and amount of the mold. He could just clean that plywood bottom and put it all back.

We were shocked and so confused. Was the first guy over reacting to get money out of us unnecessarily or did this guy have no idea what he was saying?

So, more quotes felt like the best option. We had two more booked. The next guys came and basically said the exact same thing as the first company, but their quote was like 3x’s the amount of the first guys! We explained to them the first company looked at the crawl space and there was no mold. They took their word for it and never checked.

More Leak Damage

The 4th and final company came the next day. We are so grateful they did. He arrived and was extremely thorough. He wanted to check the crawl space out himself so he and my husband went down and they determined there WAS mold in the crawl space. Directly under where the sink area of the kitchen where the leak was.

My husband said the previous guy hadn’t pulled the insulation back far enough to get a proper look. The guy also used his moisture meter under there and 3 of the floor joists were soaked to 99%!

So, moral of the story: Make sure you have multiple people inspect the damage before moving forward.

He explained to us that his company can also do all of the renovation as well. We thought this sounded great as he was explaining and we figured this was probably the route we’d go so we didn’t have to jump to different companies.

Insurance Adjuster

The following day the insurance adjuster came out. The way our insurance handles things is that they send out a 3rd party adjuster who comes to take pictures and measurements to write up their report. They then send it to the desk adjuster who goes over our policy and determines whether or not we’re covered and for what.

We had heard different stories about adjusters and how some are more relaxed than others. Thankfully our adjuster was quite generous in our coverage report.

The Waiting

We were told it could take up to 2 weeks to find out if we were covered for the leak or not. This seemed like an extremely long time considering the type of claim we were making.

We waited a couple days and then decided to call our agent and explain to him our situation. He agreed that it was too long to wait, and told us he would call his rep at the company and hopefully have an answer for us sooner.

A few hours later my husband got the call that our claim had been approved and that we were covered.

Here is a List of the Things That Were Covered:

- mitigation and remediation

- rebuild lower cabinets, and repaint cabinets to match (reusing old fronts)

- new flooring in kitchen and sunroom

- paint wherever the walls are continuous

- Extra food expenses (anything over our normal budget)

- Hotel while renovations were taking place (we chose to stay home)

Insurance paid out what their system estimates all the reno work to cost and they sent that directly to us immediately upon approval. They sent us the exact amount needed for the bill to the mitigation company.

We inquired and were approved coverage for air quality testing since we had mold. The lab came out before and after the mitigation to show the levels in the air had gone down significantly. It never hurts to ask if they’ll cover something!

Additional Living Expenses

We have an additional living expenses budget (no idea what the full amount is), that pays for things that cost more due to this loss. The purchase of a utility sink, as well as food that goes over our normal spending was covered. They completely understood that being without a sink and counter space that convenience food and take-out was expected.

So, they asked us for our normal monthly food budget and they would pay whatever extra over that we spend each month! She explained to us that it’s an honor system, and we were very honest in our reporting to them. We tracked everything in an excel sheet and also sent credit card statements in and blacking out anything that wasn’t food related. In the excel sheet, we subtracted anything we may have spent at a store that wasn’t food related. We in no way wanted to take advantage of our insurance. At the end of each month we would send in our information and they’d write us the check.

Insurance also was sure to let us know that we would be covered for a hotel if needed during the renovation period. We decided to live in the house because a hotel with children is challenging!

Settlement

The company came back to do their own report of what the insurance had done and wrote up their own report. Their estimation for the work was more than double what insurance had originally paid out. They went back and forth with our insurance and met us in the middle. So, don’t settle for the initial payout from insurance. Our company allowed us to get more quotes and submit them.

We started to work with the mitigation company on the renovations. I won’t go into all the details, but long story short we decided not to use them after waiting a month. We had decided we wanted to pay for some upgrades. There were 6, yes 6 different types of flooring on our mainfloor, so we decided that now was the time to upgrade so everything was the same.

We chose to install all new cabinets since ours are original to the 1991 house. The company wanted us to sign and hire them before even showing us the final numbers for some of the finishes. With hesitation they finally got back to us after 2 more weeks of waiting. The numbers were more than double what we were expecting based on our conversations. So, needless to say, we decided not to hire them.

Lighthouse allows us to hire whoever we want. We don’t have to use their preferred vendor like we’ve heard some other companies require. They also will allow you to pay yourself as the contractor if you want to do the work yourself!

We started looking around for other contractors. It was another long process and we decided to keep costs down we would just hire out separate companies to do the two main parts instead of paying a contractor. We hired one company to do the floors, and another to do the cabinets and we are doing all the painting ourselves!

These are the things we wished we knew when making our first homeowners insurance claim:

1. Call your agent if you have any questions before or during the claim process.

Our agent sped up the process when things could’ve taken up to 2 weeks, he literally had us our answer within a few hours.

2. Don’t Settle for the First Payment

If your insurance allows, get more quotes from multiple places. Hopefully, like ours, they’ll see the work does cost more and be willing to pay you more!

3. Find an Independant Contractor Not a Mitigation Company for Your Repairs

In our experience, I just cannot emphasize this enough. This company was great about the mitigation part, but terrible on the renovations part. I urge you to find a company whose top priority is you. At one point the company basically told us “You just have to understand that other people with losses have come into our system so now you have to wait until we can get to your stuff”. Of course, we understand getting a loss cleaned up is extremely important, but being put on the back burner for over a month is also stressful.

4. Don’t Be Afraid to Ask Your Adjuster Questions

The mitigation company told us things we later found out were incorrect (like insurance would warranty the work done). They also made us feel like it would be a terrible idea to call the adjuster and only they should call. We went against that advice thankfully!

Our adjuster was so very kind and helpful. Remember, they’re people too, and as much as they don’t want to pay out more than what’s necessary, they do want to provide excellent customer service.

Overall we are thankful for our the proces So thankful that this all worked out the way it did!